Your True Financial Partner

Become a member today and we’ll help you on the pathway to a secure financial future.

Open Account Apply for a Loan

Accounts for Any Stage of Life

Digital Banking Experience

1,000s of Branches Nationwide

Great Rates & Low Fees

Make Your Money Work

Earn more and spend less. Get great rates on accounts for any stage of life.

-

Personal Investments

Share Certificates

3.55 %APYAs High As

- A competitive fixed rate for the duration of the certificate term

- A diverse range of term options, including 6, 12, 24, 36, 48 or 60 months

- Open an account with a minimum deposit of just $500.

-

Checking

Swipe2Save Checking

10 %APY Owner Rewards Purchase Round-Up

- Round Up Your Purchase & Deposit the Difference

- Earn 10% APY when you also open an Owner Rewards Savings Account

-

Checking

Basic Checking

$ 0Fees & Service Charges

- Unlimited transactions

- Dividends paid on average daily balances of $250 or more

- Overdraft Privilege Protection

-

Checking

Youth Swipe2Save Checking

$ 0Fees & Service Charges

- Youth Debit Card

- Pay Allowance

- Track Spending

-

Savings

Regular Share Savings

0.05 %APYAs High As

- Establish your membership with the credit union

- Save for your immediate financial future

- Offers flexibility in accessing funds

-

Savings

Holiday Club

0.05 %APYAs High As

- Set aside money for specifically for the holidays

- On October 1, the balance of your Holiday Club Account is automatically transferred into your Regular Share Account

-

Savings

Vacation Club

0.05 %APYAs High As

- Set aside money for specifically for your vacation

- Transfer your Vacation Club funds to your Share Account any time or withdraw at any of our surcharge-free ATM machines

-

Savings

Health Savings Account (HSA)

0.50 %APYAs High As

- Easy application process

- Transferable in the event of job change

- Covers most medical, dental, and prescription costs

-

Credit Cards

MasterCard Cash Back Rewards

16.74 %APRAs Low As

- 1.5% CASH BACK for each dollar spent

- 0% balance transfer

- NO Annual Fee

-

Credit Cards

Low Rate Credit Card

11.74 %APRAs Low As

- Our lowest rate credit card option

- Flexible spending power

- NO annual fee

-

Savings

Owner Rewards

10.00 %APYAs High As

- Earn 10.00% APY on select savings deposited into the account.

- Grow your savings with a Swipe2Save account or a MasterCard Credit Card.

-

Checking

Love My Crew Checking Account

-

Vehicle Loans

New & Used Vehicle Loan

5.24 %APRAs Low As

- Fast and local decision-making

- Financing terms up to 85-months

- 100% financing available

-

Vehicle Loans

Vehicle Loan Refinance

4.24 %APRAs Low As

- Fast and convenient ways to apply online, in person, or over the phone in less than 15 minutes

- You could save hundreds

-

Vehicle Loans

Motorcycle, Boat and RV Loans

8.19 %APRAs Low As

- No payments for up to 90 days

- Convenient financing terms

- No early-payment penalties

-

Personal Loans

Lifestyle Personal Loan

10.44 %APRAs Low As

- Quick and convenient financing with trusted financial partners.

- Your loan is local, meaning your money stays right here in our central Ohio communities.

-

Personal Loans

Personal Secured Loans

10.95 %APRAs Low As

- Quick and convenient financing with trusted financial partners.

- Your loan is local, meaning your money stays right here in our central Ohio communities.

-

Personal Loans

MyFlexLine

15.04 %APRAs Low As

- Quick and convenient financing with trusted financial partners.

- Your loan is local, meaning your money stays right here in our central Ohio communities.

-

Student Loans

Student Loans

$ 1000Minimum Loan

- Competitive interest rates

- Multiple repayment options

- No origination fees; no prepayment penalty

-

Home Equity

Home Equity Loan

Max 90 %Of Your Home's Appraised Value

- Maximum term of 15 years

- Finance up to 90% of your home’s appraised value

-

Home Equity

Power Equity Line of Credit

$ 100kMaximum Line

- Rates some of the best in the market

- NO annual fee or closing costs

-

Mortgages

Fixed-Rate Mortgage

30 YrsMaximum Term

- Terms up to 30-years available

- Low down payments

- Predictable monthly payments

-

Mortgages

Adjustable-Rate Mortgage (ARM)

- Low, competitive interest rates

- Start with a fixed interest rate for a set period of time, then adjusting when interest rates change over the life of the loan

-

Mortgages

The Game Changer Mortgage

$ 299Closing Costs

- 10-year to 15-year term options available

- Lower your interest rate and potentially your monthly payment!

- Reduce the amount of time owed on your mortgage

-

Mortgages

FHA and VA Loans

$ 0Down Payment

- Low or no down payment options with flexible credit requirements.

- For qualifying veterans or buyers who qualify for FHA loans.

-

Personal Loans

Credit Builder Loan

-

Personal Loans

iCash Life Event Loan

-

Mortgages

Mortgage Loans

-

Checking

Business Basic Checking

$ 25Minimum Balance to Open

- 50 free transactions/month

- NO monthly service fee

- Bill pay available for $10/month

-

Checking

Business Organizational/Club Checking

$ 25Minimum Balance to Open

- NO monthly service fee

- 50 free transactions/month

- Account-to-account transfer to another financial institution available for $10/month

-

Checking

Business Plus Checking

$ 50Minimum Balance to Open

- Low $8 monthly maintenance fee

- 200 free transactions/month

- Bill pay available for $10/month

-

Checking

Business Premium Checking

$ 100Minimum Balance to Open

- $20 monthly maintenance fee – waived if aggregate daily balance is $7,500+

- 400 free transactions/month

- Bill pay available for $10/month

-

Credit Cards

Business Rewards Credit Cards

16.74 %APRAs Low As

- No annual fee

- Individual billing for each user

- Corporate level consolidated billing available.

-

Savings

Business Savings

0.05 %APYAs High As

- Offers flexibility in accessing your funds

- Low minimum opening deposit of $5

-

Business Investments

Business Money Market

$ 2500Minimum opening deposit

- No-risk account – not tied to the stock market

- Offer a competitive rate of return, but with more flexibility in accessing funds than a Share Certificate

-

Business Investments

Business Share Certificates

3.55 %APYAs High As

- Offer the best possible rates at Pathways

- Funds are secured for a set amount of time

- A guaranteed way for you to maximize your business savings

-

Business Loans

Business Term Loans

- Long term capital

- Flexible usage for the loan funds

-

Business Loans

Business Lines of Credit

- Terms up to 60 months.

- Only pay interest on what you use.

-

Business Loans

SBA Loans

- Loans insured by the government

- Flexible usage of loan funds

-

Real Estate

Commercial Real Estate Loans

- We will work with your team to help structure the loan you need

- Flexible terms

-

Real Estate

Business Leasing

- Local loans

- Competitive rates

-

Business Services

Merchant Card Processing

- Merchant Card Processing

- Industry Specific Solutions

-

Personal Investments

Share Certificates

3.55 %APYAs High As

- A competitive fixed rate for the duration of the certificate term

- A diverse range of term options, including 6, 12, 24, 36, 48 or 60 months

- Open an account with a minimum deposit of just $500.

-

Checking

Swipe2Save Checking

10 %APY Owner Rewards Purchase Round-Up

- Round Up Your Purchase & Deposit the Difference

- Earn 10% APY when you also open an Owner Rewards Savings Account

-

Checking

Basic Checking

$ 0Fees & Service Charges

- Unlimited transactions

- Dividends paid on average daily balances of $250 or more

- Overdraft Privilege Protection

-

Checking

Youth Swipe2Save Checking

$ 0Fees & Service Charges

- Youth Debit Card

- Pay Allowance

- Track Spending

-

Savings

Regular Share Savings

0.05 %APYAs High As

- Establish your membership with the credit union

- Save for your immediate financial future

- Offers flexibility in accessing funds

-

Savings

Holiday Club

0.05 %APYAs High As

- Set aside money for specifically for the holidays

- On October 1, the balance of your Holiday Club Account is automatically transferred into your Regular Share Account

What Our Members Are Saying

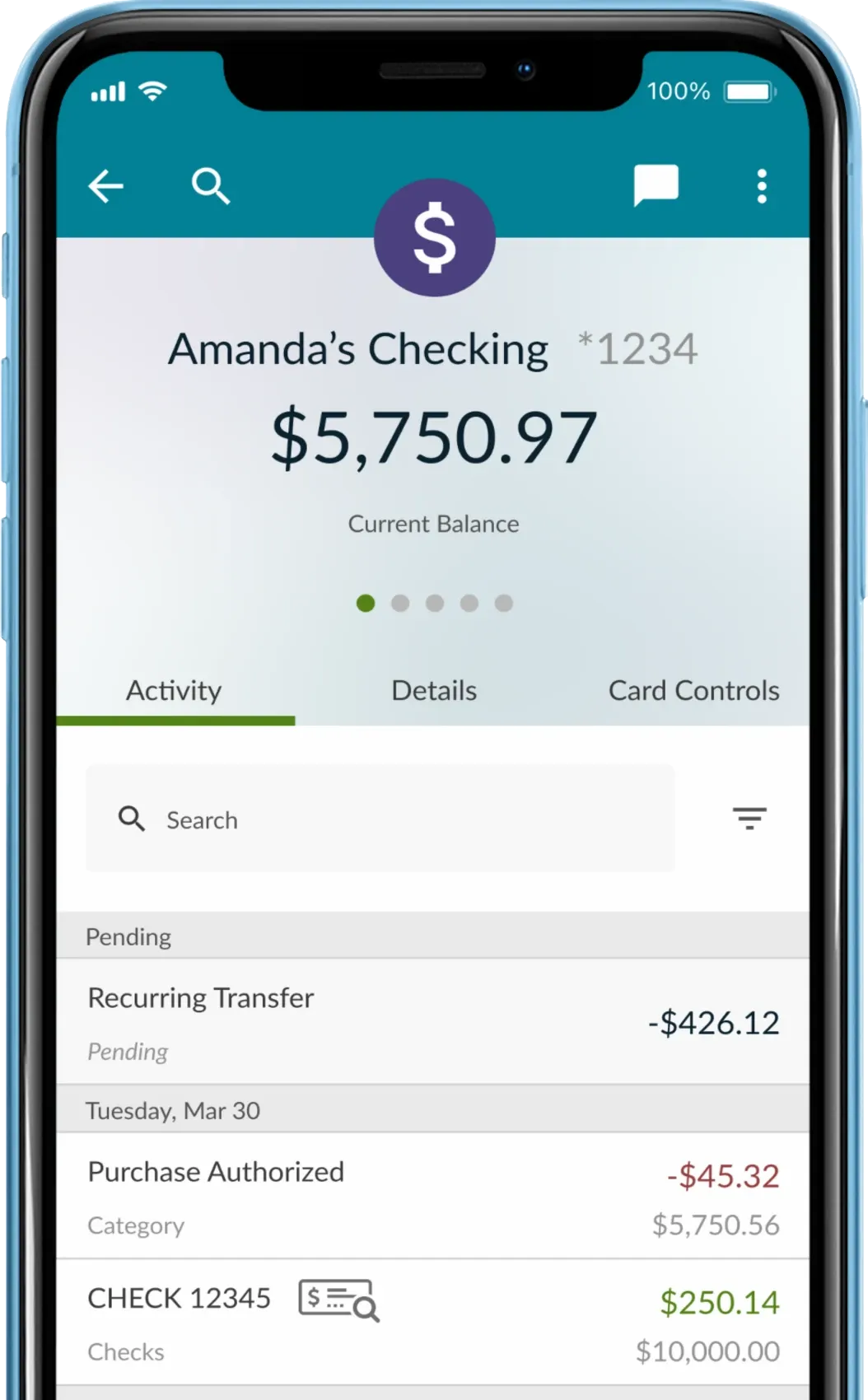

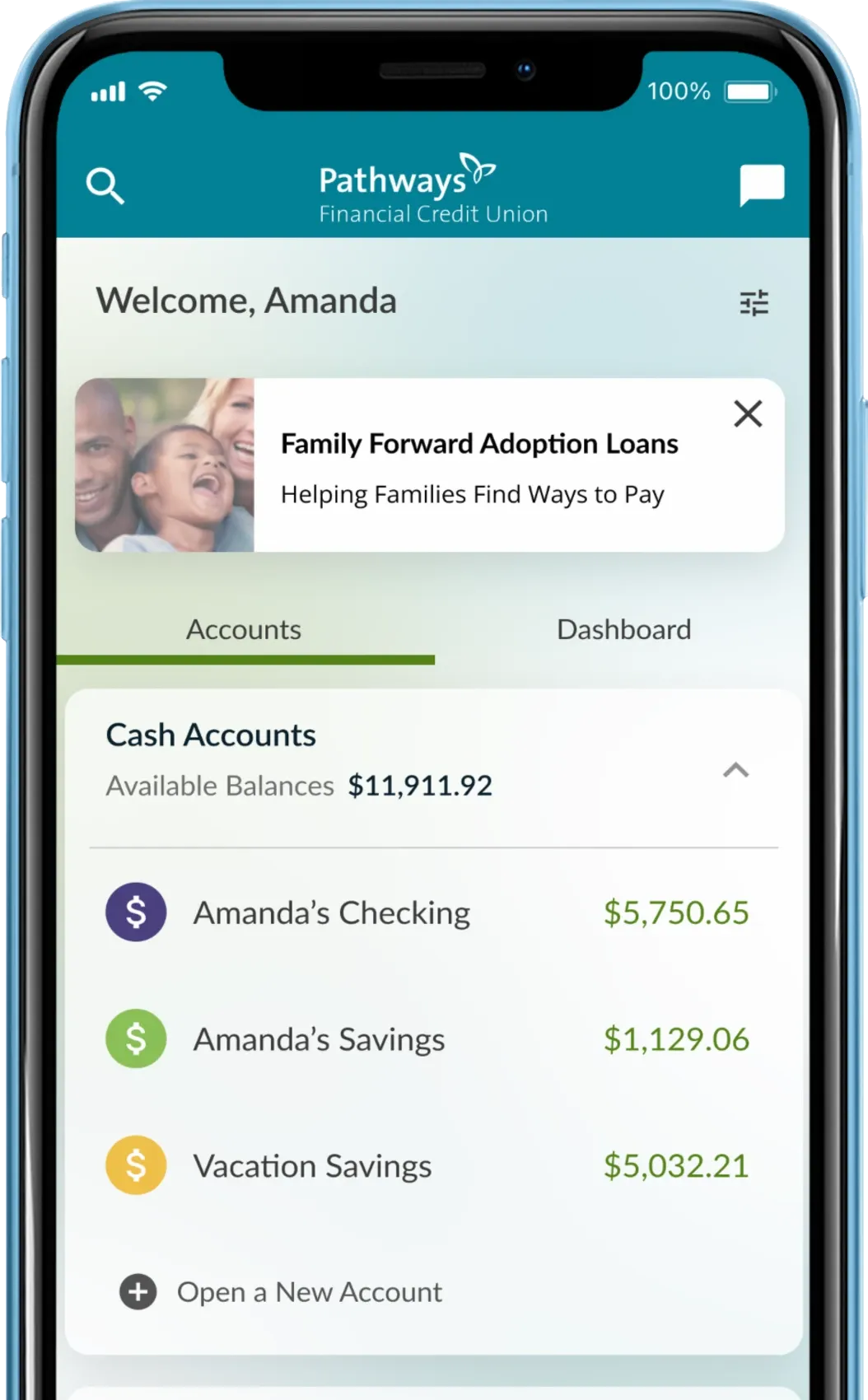

Meet the Credit Union of the Future.

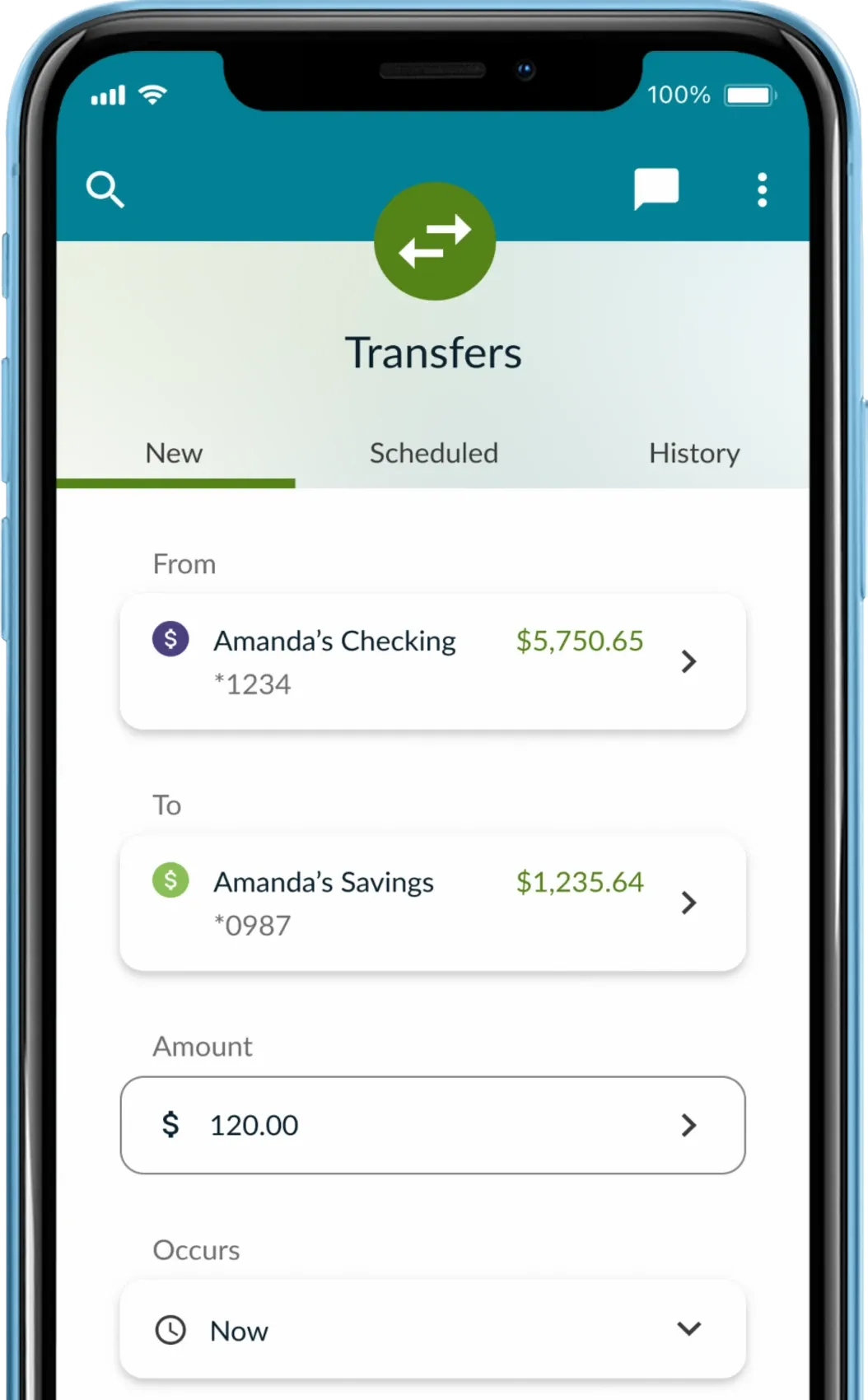

You can quickly see all your banking transactions from the palm of your hand. Account information is updated immediately so you’ll always be in the know.

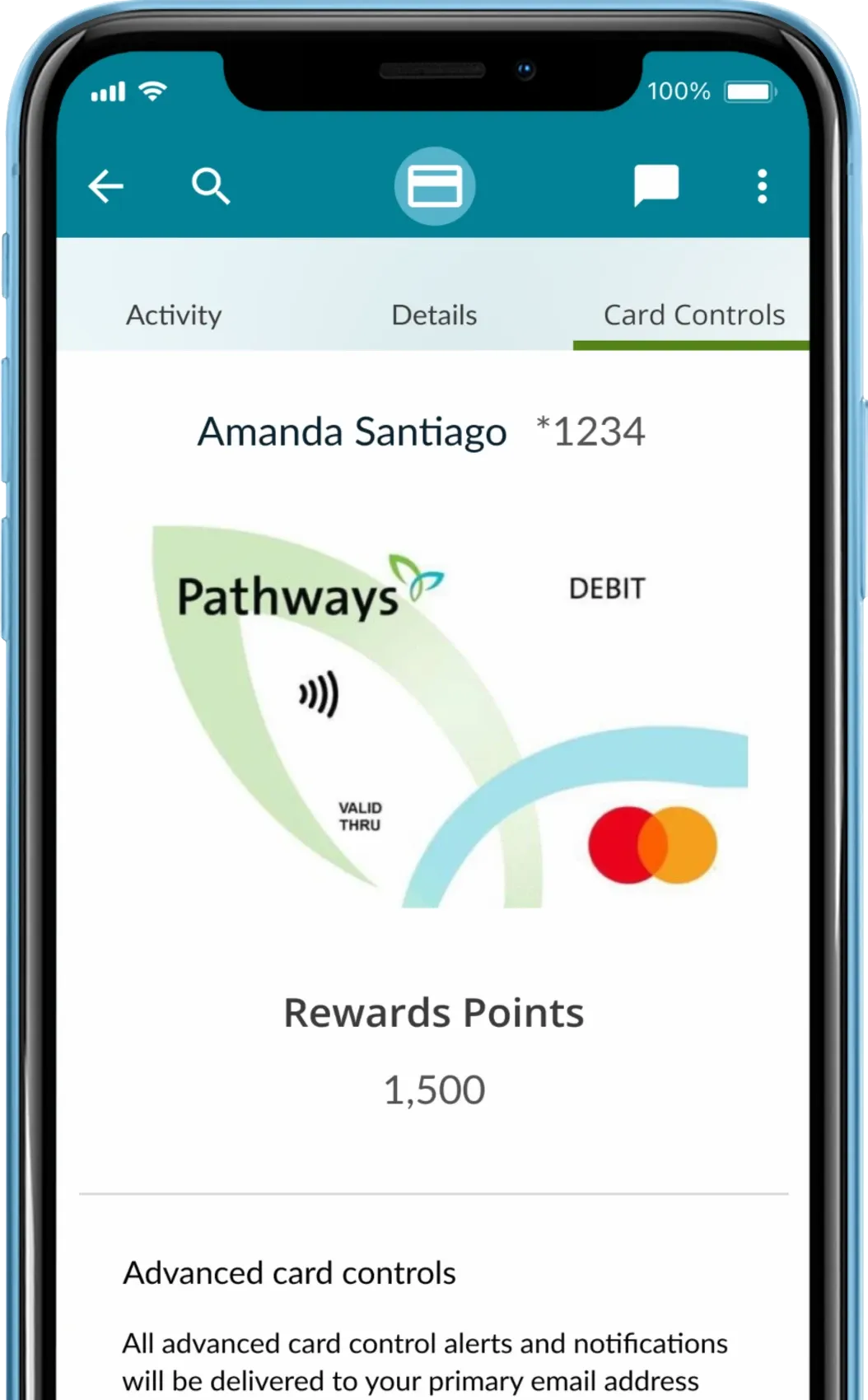

Security and convenience align with the integrated card controls feature, which allows you to turn cards off and on, add travel notices, order new cards, and create alerts.

Manage and transfer funds between ALL of your accounts (even outside financial institutions), and request online wire transfers.

A pie chart allows you to quickly view and understand your spending habits with categories you can customize and create alerts.

Your Financial Questions, Answered

We’re passionate about helping you succeed in all areas of your financial life.

Check out our in-depth resource guides that will help you achieve your financial goals, whether you are looking to save for retirement or start a new business.

Community Events

We are committed to the communities we serve. See below for some upcoming events!

You're About to Leave the Pathways Credit Union Website

By clicking continue, you are leaving Pathways Financial Credit Union's website and accessing the site of a third party not related to or controlled by the Credit Union. We are not responsible for the products, services, or content found at this third-party site; nor does our privacy policy cover any third-party website. Please consult the privacy disclosures on the third-party website you are visiting for further information.

Continue to