Automated Investing Made Simple with EasyVest

Dive into the world of investing with EasyVest, your partner in financial growth. At Pathways Financial Credit Union, we're committed to making investment opportunities accessible and manageable for everyone. EasyVest, our automated investment platform, is designed to help you begin your investment journey with confidence and ease. 1

Get StartedWhy EasyVest is the Right Choice for You

Start Small, Dream Big

Begin investing with as little as $50. No matter your financial goal—be it saving for a new home, planning for retirement, or building wealth—EasyVest makes it possible.

Completely Digital

EasyVest simplifies your investment process. Our platform manages your investments by continuously analyzing market data to optimize your portfolio according to your goals.

Tailored to Your Needs

After a brief questionnaire about your financial objectives and preferences, EasyVest crafts a strategy that’s personalized just for you. This strategy adjusts dynamically to align with your evolving financial landscape.

How It Works

Join the many who have trusted Pathways Financial Credit Union to secure and advance their financial future.

Follow these easy steps and begin your journey towards a profitable financial future.

-

Quick Setup

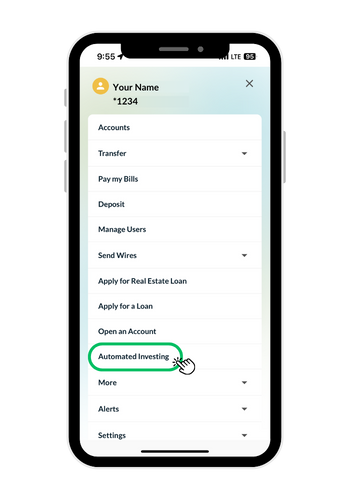

Login to Pathways Online Banking and click on the "Automated Investing" tab to get started.

-

Personalize Your Plan

Answer the questions and share your financial aspirations with us. Whether you’re looking to grow your wealth or prepare for future expenses, we cater the strategy to fit your needs.

-

Invest and Watch Your Wealth Grow

With your initial investment, watch as EasyVest takes the lead in nurturing your portfolio. Investing has never been more straightforward or more secure.

FAQs

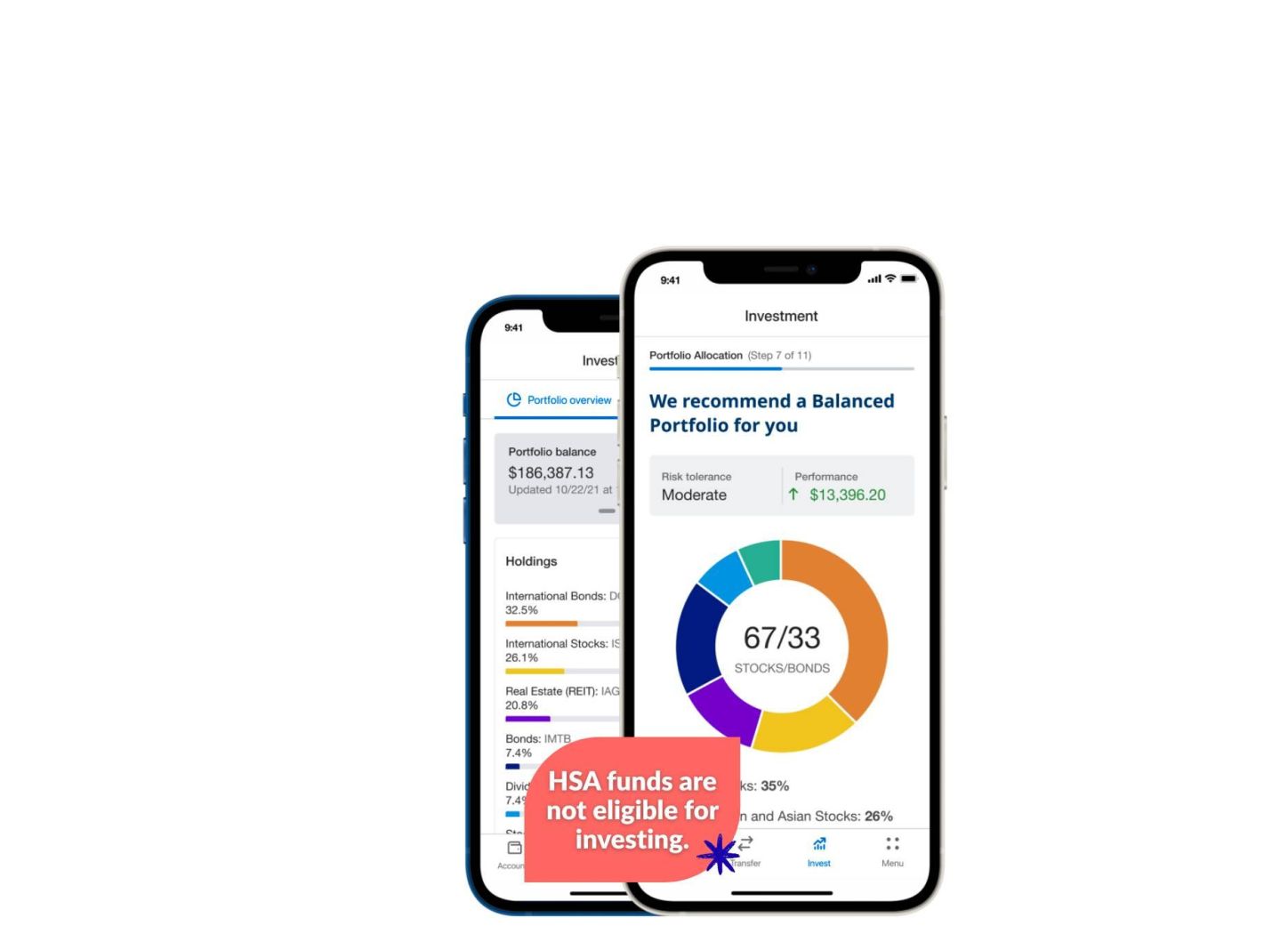

Upon registration, you’ll be asked questions to better understand your goals, aversion to risk, and retirement timeline. The automated investment platform will make an investment recommendation based on your results that will fund the account with your eligible Pathways deposit account. When using EasyVest, you create an investment account that invests in securities. Your account is not a Pathways share. The investment account is held at DriveWealth, LLC, a securities brokerage firm that is not associated with Pathways. The account is managed by Access Softek Advisory Services, LLC, which is also not affiliated with Pathways. *Please Note: HSA funds are not eligible for investing.

Your Dreams, Our Mission. Start with EasyVest.

You will login to your Pathways online banking account and navigate to the "Automated Investing" tab to get started. We will guide you through the quick process.

Get Started