Welcome Springfield Postal Employees Federal Credit Union Members!

On behalf of the Board of Directors and the Pathways Financial Credit Union team, we warmly welcome you to YOUR credit union! We are excited to announce the merger of Springfield Postal Employees Federal Credit Union (SPEFCU) with Pathways Financial Credit Union. Below you will find essential information and dates regarding the transition.

Welcome you to your credit union!

We look forward to having you as a valued member owner of Pathways, serving all your financial needs and helping you achieve financial success.

If you have any questions or would like to learn more about Pathways, visit our Springfield Branch at 1850 South Limestone Street, or any of our other convenient branch locations in Dayton, Central Ohio or Southwest Ohio.

Contact Information

Pathways associates are available via phone for any questions you may have:

Phone: (614) 416-7588 or (800) 367-7485, option 4

Contact Center Hours:

| Monday - Friday | 8:30 AM - 5:00 PM EST |

| Saturday | 9:00 AM - 12:00 PM EST |

Important Dates & Information

August 30, 2024: At 5:00 PM, SPEFCU office located at 150 N Limestone St, will close permanently to facilitate the merger.

September 3, 2024: SPEFCU will officially become part of Pathways Financial Credit Union.

Our goal is to make this transition as smooth as possible for you.

You can visit Tim and Marci at the Springfield branch where they will have limited office hours until the end of the year.

Welcome Packet

Welcome packets were mailed to members beginning on August 22nd. If you did not receive one or if you have misplaced your copy, you can view a copy of it by clicking the button below. This packet contains crucial information about your account and the merger process.

New Account Information

Your SPEFCU savings account has been converted into a Pathways Regular Savings account.

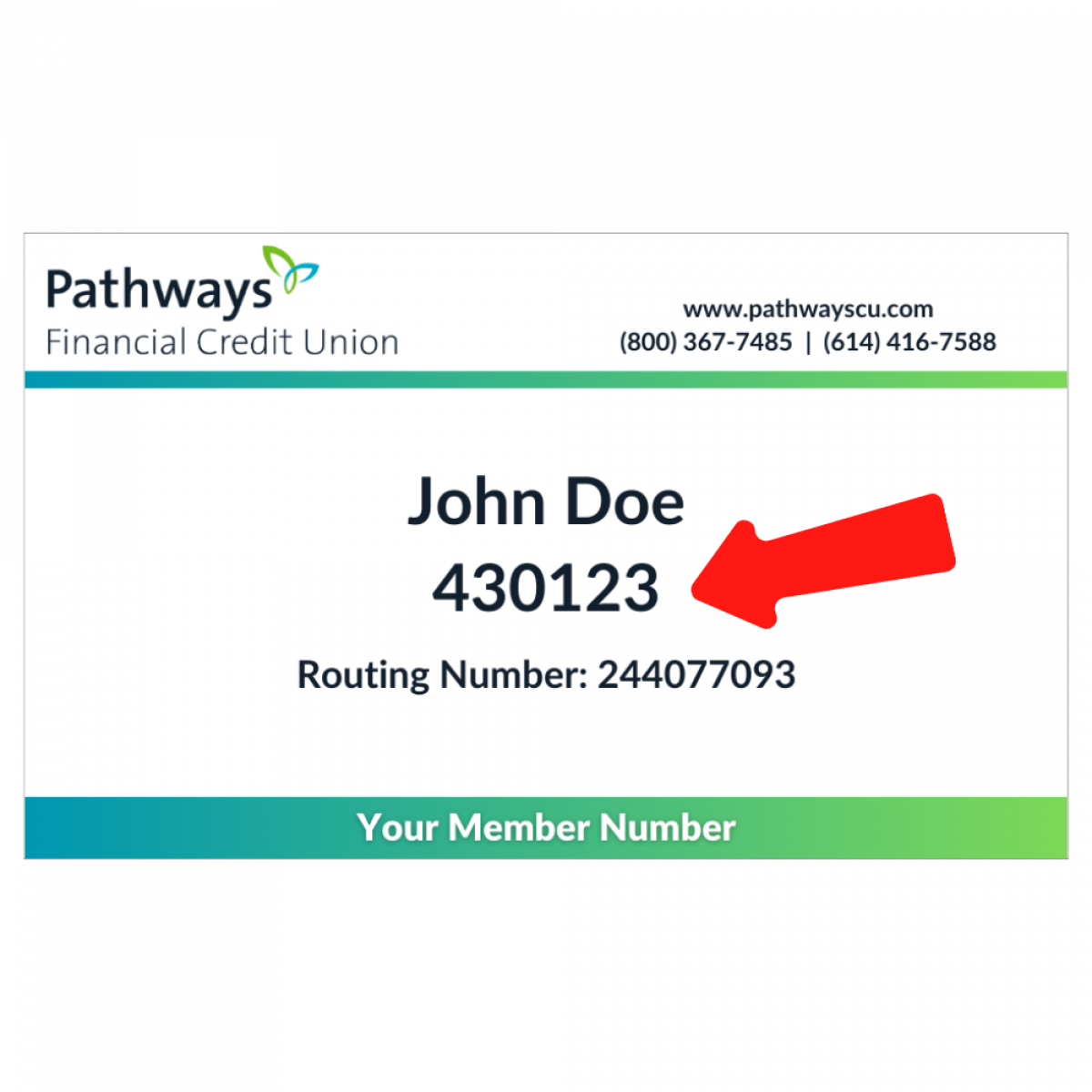

As part of this transition, your account number has been updated to align with our system. You can find this number on the membership card included in this mailing.

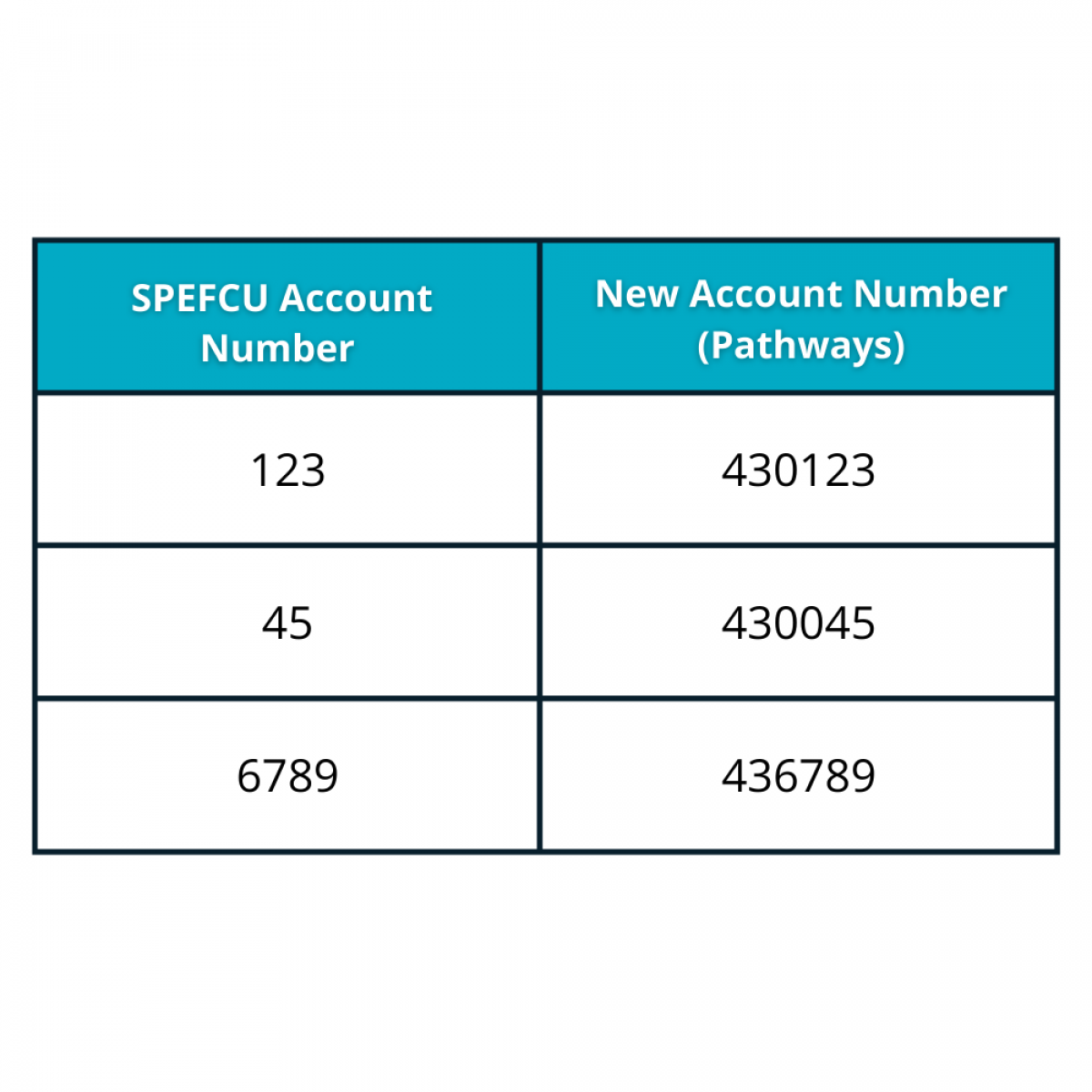

Account Number

Your new account number will now start with the numbers 43, followed by enough zeros to reach a six-digit format.

For instance, if your previous account number was 123, your new account number will be 430123.

Your account number might also be referred to as your "Member Number."

Special Offers

If you open a Swipe2Save Checking Account between now and October 31, we'll give you $100.00 CASH* deposited into your Pathways account. When you open a Swipe2Save Checking account, we’ll also open a high yield Owner Rewards account for you. Each time you use your Pathways debit card, we will round up your purchase and deposit the round up proceeds to your Owner Rewards account.

All you have to do is:

Complete one (1) direct deposit of at least $100 or more, OR Complete ten (10) debit card transactions (ATM transactions excluded).

PLUS you’ll have the opportunity to transfer your bonus dividend payment to your Pathways Owner Rewards share account, which earns an APY of 10.00%* on balances up to $5,000. This is a very special opportunity, because you cannot normally transfer funds or make deposits to this share account – it is only for Owner Rewards or round up proceeds from your debit card purchases!

Pathways Online Banking

Get familiar with Pathways Online Banking:

Enroll in Online Banking: Enrollment will be available starting September 3, 2024.

Mobile Banking Apps: Download links for our Apple and Android mobile banking applications are available on our mobile and text banking page.

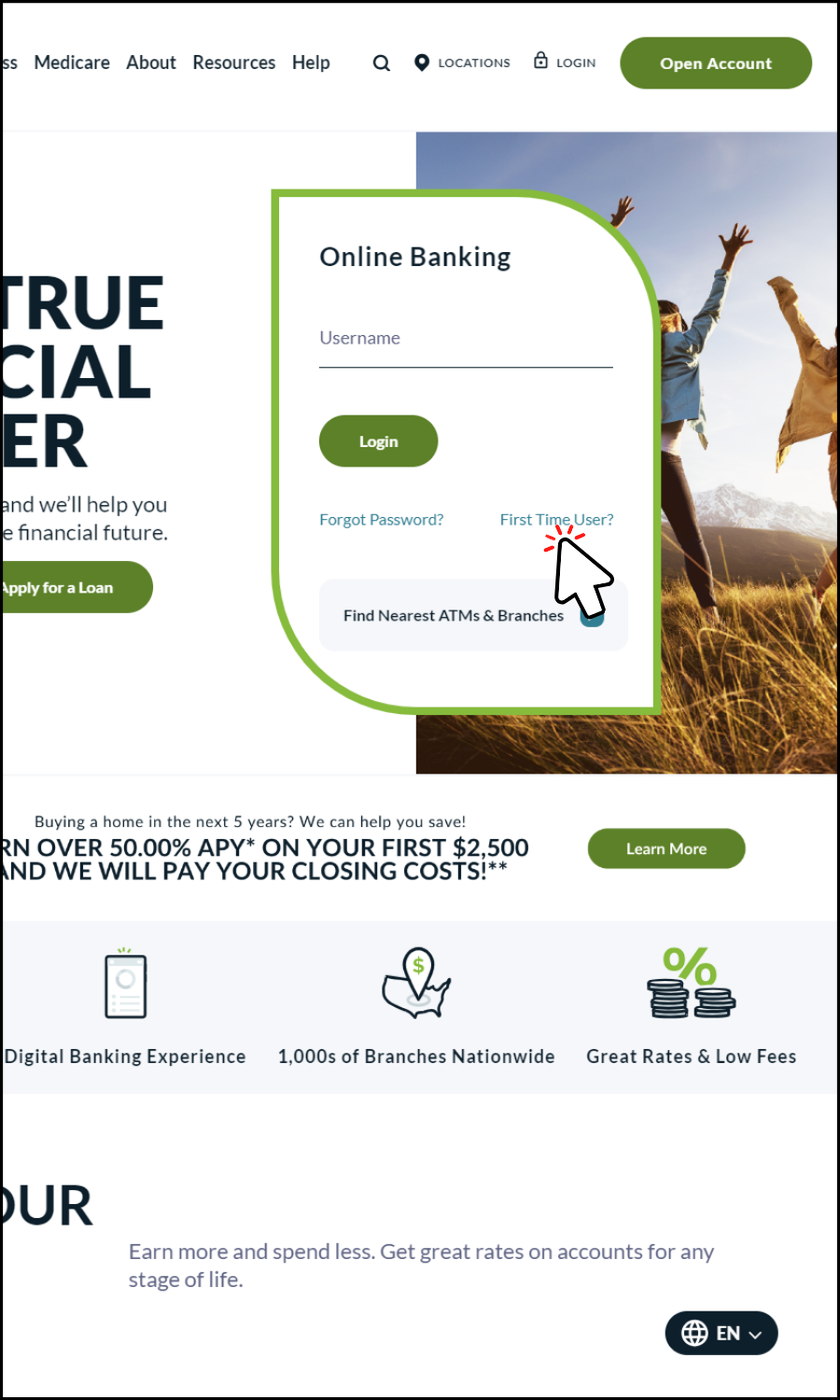

How Do I Enroll in the Pathways Online Banking Platform?

You will be able to enroll in Online Banking on September 3, 2024. Visit our homepage and click on “First Time User” in the Online Banking Access near the middle of the homepage. Follow the prompts for the initial setup.

Once you have enrolled in online banking, you will have access our full suite of online services!

You will be able to enroll in Bill Pay only if you open a Pathways Checking Account.

-

Register

Register as an individual – either as the primary account holder or joint owner.

-

Enter Member Number

Follow the prompts and enter your new member number, name, address, social security number and date of birth for verification.

-

Authenticate

Authenticate your account by entering the security code you receive by either text (for a mobile phone) or voice call (for landline phones).

-

Credentials

Create a username and password.

-

Provide Consent

Consent to the Pathways online and mobile banking agreement.

-

Update Personal Information

Once you have completed your online banking enrollment, please update your contact information (e-mail address and telephone numbers).

Direct Deposit & Daily Pay Deposit Information

Set Up

Consider a more seamless and efficient way to receive your paycheck with Pathways’ Direct Deposit and Daily Pay Deposit services. Why should you use Direct Deposits and Daily Pay Deposits?

Instant Deposits for Early Access: Opt for Pathways’ Instant Deposit service to receive your pending Direct Deposits up to 2 days in advance for a small fee of $5.

Efficiency: Swift access to your funds without the wait associated with traditional checks.

Security: Enjoy peace of mind with a secure and automated transaction process.

Streamline your bill payments:

Did you know you can streamline your bill payments with ease? By using your MICR and routing numbers, you can establish direct payments for bills and more directly from your bank account. This not only saves you time but also ensures your payments are consistently on schedule.

-

Access Online Banking

Log in to your Online Banking account.

-

Select Your Designated Account

Choose the account where you wish to receive your direct deposits and/or Daily Pay Deposit.

-

Navigate to Account Details

Click on "Details" to access your account's MICR number. Pathways routing number is 244077093.

-

Share Information with Your Employer

Provide your employer with the MICR and routing number for seamless Direct Deposit and Daily Pay Deposit.

Introducing Shared Branching!

One of the perks of Pathways membership is access to the CO-OP shared branching network. Shared Branching is a network of credit unions that have joined together and created shared service centers across the country. That means you can access your accounts at thousands of credit union service center locations nationwide.

Whether you’re in the next town over or traveling far and wide, you’ll find a partnering credit union near you thanks to the convenience of Shared Branching. It’s like having a Pathways branch wherever you go! Want to see the closest shared branch near you?

Go to Shared Branching Homepage to search the entire network. To use this service, call us at 614-416-7588 to confirm your Shared Branch access is activated.

*APY = Annual Percentage Yield. Swipe2Save Owner Rewards Savings Account balances $5,000 and under will earn 10.00% APY compounded and credited quarterly; balances exceeding $5,000 will earn regular Secondary Savings APY. Consult the Credit Union’s Account Disclosure Rate Supplement for current APY. Round-up deposits will not be made in the instance of a negative checking account balance. The only deposits permitted into Swipe2Save Owner Rewards Savings Account are loan interest rebates, Pathways cash back credit card points redeemed for cash, round-up deposits from debit card transactions, and applicable credit union match funds. Share and checking accounts are federally insured for up to $250,000 by the National Credit Union Administration (NCUA). Savings rates are subject to change without notice. We reserve the right to end or extend this offer at any time.

You're About to Leave the Pathways Credit Union Website

By clicking continue, you are leaving Pathways Financial Credit Union's website and accessing the site of a third party not related to or controlled by the Credit Union. We are not responsible for the products, services, or content found at this third-party site; nor does our privacy policy cover any third-party website. Please consult the privacy disclosures on the third-party website you are visiting for further information.

Continue to